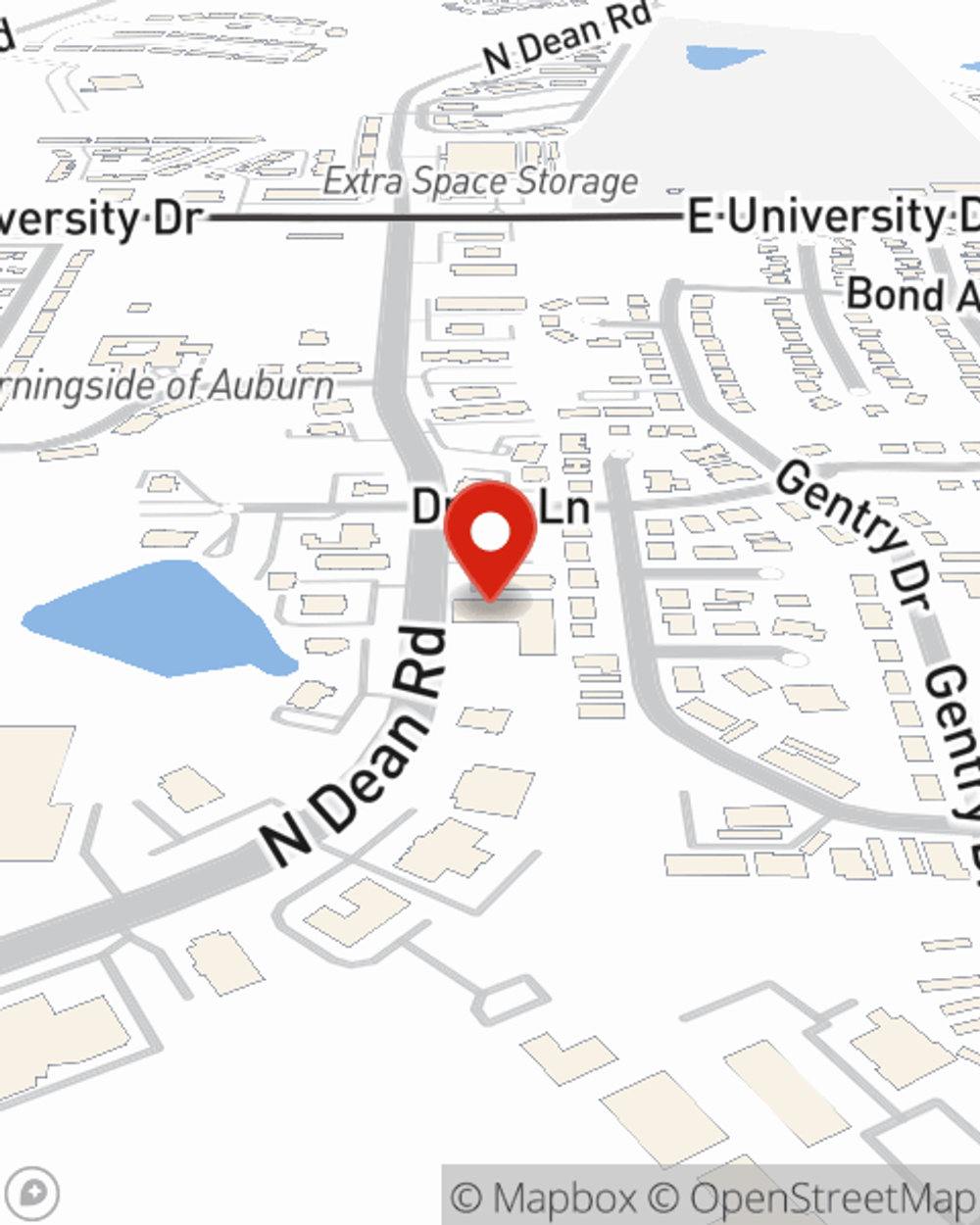

Business Insurance in and around Auburn

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Your Search For Remarkable Small Business Insurance Ends Now.

Small business owners like you have a lot of responsibility. From financial whiz to product developer, you do whatever is needed each day to make your business a success. Are you an acupuncturist, a dog groomer or a florist? Do you own a cosmetic store, an art gallery or a vet hospital? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, worker’s compensation or surety and fidelity bonds.

Let's discuss business! Call Scott Holley today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Scott Holley

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.